Real estate has long been considered a reliable and profitable investment. It offers the potential for consistent income, long-term appreciation, and diversification in a portfolio. Many investors view real estate as a way to build wealth over time while generating passive income through rental properties. However, one of the common misconceptions is that investing in real estate requires a large amount of capital. While traditional property purchases can be expensive, there are several ways to get started with real estate investing, even with a limited budget.

The Benefits of Real Estate Investing

- Steady cash flow: Rental properties can generate consistent monthly income.

- Appreciation: Over time, real estate tends to increase in value, allowing investors to benefit from long-term growth.

- Tax benefits: Real estate investors can take advantage of tax deductions related to mortgage interest, property taxes, and depreciation.

- Portfolio diversification: Adding real estate to your investment portfolio provides diversification, helping to reduce risk.

For investors with limited funds, understanding how to leverage available resources and explore alternative investment methods can make real estate a viable option.

Real Estate Investment Trusts (REITs): An Affordable Entry Point

One of the easiest and most affordable ways to invest in real estate with a limited budget is through Real Estate Investment Trusts (REITs). REITs allow individuals to invest in large, income-generating properties without the need to directly purchase or manage real estate. REITs are companies that own and operate real estate assets such as commercial properties, apartment complexes, or industrial facilities. By investing in REITs, you can earn a portion of the income generated by these properties through dividends.

Why REITs Are Ideal for Small Investors

- Low minimum investment: You can start investing in REITs with a small amount of money, often as little as the price of one share.

- Liquidity: Unlike direct property investments, REITs are traded on stock exchanges, meaning you can easily buy and sell shares, providing greater liquidity.

- Diversification: REITs invest in a broad range of properties, offering built-in diversification even with a small investment.

- Passive income: REITs are required to distribute at least 90% of their taxable income to shareholders, making them an excellent source of dividend income.

For investors with limited capital, REITs provide an opportunity to gain exposure to real estate and earn income without the complexities of managing property.

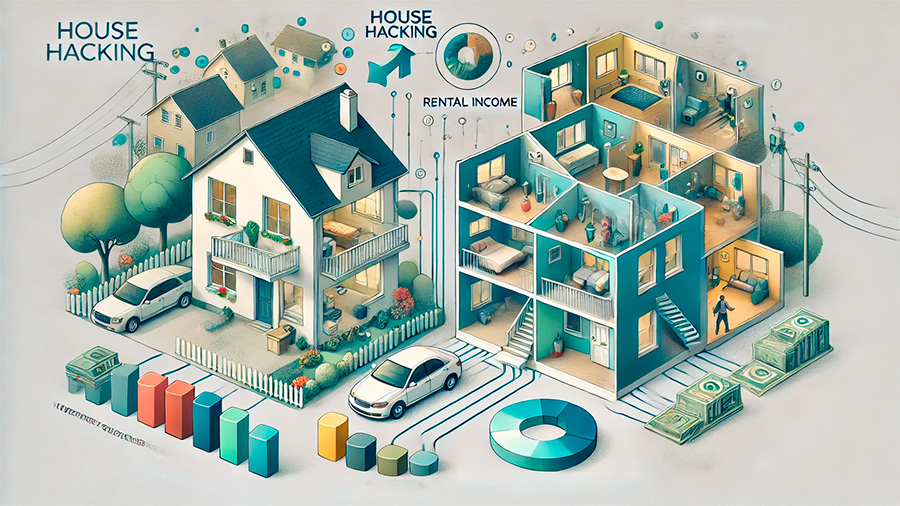

House Hacking: A Creative Way to Invest

House hacking is a strategy where you purchase a property and live in part of it while renting out the remaining space. This approach allows you to generate rental income that can help offset your mortgage payments, lowering your overall housing costs. House hacking can be done with single-family homes by renting out rooms or with multi-family properties where you live in one unit and rent out the others.

How to Start House Hacking

- Purchase a duplex or multi-family property: By living in one unit and renting out the other(s), you can cover a significant portion (or even all) of your mortgage payment with rental income.

- Rent out extra space: If buying a multi-unit property isn’t feasible, consider renting out a room, garage, or basement in your home.

- Leverage FHA loans: First-time homebuyers can take advantage of FHA loans, which allow for low down payments (as low as 3.5%) on properties with up to four units.

House hacking is an excellent way to get into real estate with a limited budget while benefiting from rental income and property appreciation.

Real Estate Crowdfunding: Pooling Resources for Bigger Investments

Real estate crowdfunding platforms allow investors to pool their money together to invest in larger real estate projects, such as commercial buildings, apartment complexes, or development projects. These platforms give small investors access to deals that would normally require significant capital. Through crowdfunding, you can invest in a fraction of a property and earn returns based on your share of ownership.

Benefits of Real Estate Crowdfunding

- Low entry point: Many crowdfunding platforms allow investments with as little as $500 to $1,000.

- Access to large-scale projects: Crowdfunding lets you invest in properties and projects that would otherwise be out of reach for individual investors.

- Diversification: You can invest in multiple properties across different markets, helping to spread your risk.

- Passive investment: Once you invest through crowdfunding, the platform typically handles property management and other responsibilities, allowing for a hands-off investment.

Real estate crowdfunding offers an accessible way to participate in larger real estate deals without needing substantial capital upfront.

Buying a Rental Property with a Small Budget

While purchasing a rental property traditionally requires a significant down payment, there are ways to buy investment properties with a limited budget. By using financing options and considering different types of properties, you can get started with rental property investing without needing a large amount of capital.

Strategies for Purchasing a Rental Property on a Budget

- FHA loans: If you’re a first-time homebuyer, an FHA loan allows you to buy a property with a down payment as low as 3.5%. You can use this loan to buy a multi-unit property, live in one unit, and rent out the others.

- Look for distressed properties: Properties that need renovation or are being sold below market value (due to foreclosure or short sale) can offer opportunities for investors with smaller budgets.

- Partner with other investors: By teaming up with other investors, you can pool resources to purchase a rental property and share the profits.

While purchasing a rental property may require some creativity and strategic financing, it’s possible to get started with less capital than you might expect.

Wholesaling: A No-Capital Approach to Real Estate Investing

Wholesaling is a real estate investment strategy that involves finding properties at below-market prices and then assigning the contract to another buyer for a fee. As a wholesaler, you don’t actually purchase the property, but instead act as a middleman between the seller and the buyer. This approach requires no money down and is an effective way to enter the real estate market without needing a large budget.

How Wholesaling Works

- Find distressed properties: Look for sellers who are motivated to sell quickly, such as those facing foreclosure or needing to move.

- Negotiate a contract: Once you find a property, negotiate a purchase contract at a low price.

- Assign the contract: Rather than closing on the property, you assign the contract to another buyer for a fee, typically $5,000 to $10,000 or more, depending on the deal.

Wholesaling can be a profitable way to enter the real estate market with little to no capital, but it requires strong negotiation skills and knowledge of the local market.

Rent-to-Own: A Pathway to Property Ownership

Rent-to-own agreements provide an alternative for those who want to own property but don’t have enough savings for a down payment. In a rent-to-own arrangement, you agree to rent a property with the option to purchase it after a specified period. A portion of your monthly rent payments is typically applied toward the eventual down payment or purchase price of the home.

Advantages of Rent-to-Own

- Build equity while renting: Part of your rent goes toward purchasing the home, allowing you to build equity over time.

- Locked-in purchase price: The purchase price is often agreed upon upfront, which can be beneficial in a rising market.

- Time to improve credit: Rent-to-own gives you time to improve your credit score or save for a larger down payment while still moving toward homeownership.

Rent-to-own can be an effective way to enter the real estate market, especially for those who are not yet ready to commit to buying a property but want to work toward ownership.

Final Considerations for Budget-Conscious Real Estate Investors

Real estate investing is not limited to those with large amounts of capital. By exploring alternative investment options such as REITs, house hacking, crowdfunding, and wholesaling, individuals with limited budgets can still take advantage of the benefits that real estate offers. It’s essential to assess your financial goals, risk tolerance, and available resources when deciding which strategy to pursue. With careful planning and creative approaches, you can start building a real estate portfolio, even with a small budget.

No matter your starting point, real estate can offer opportunities for long-term growth, income generation, and wealth-building.